Your Real ROI

Building upon prior posts, this next post looks at your real ROI (Return on Investment). Specifically, we evaluate inflation-adjusted earnings of the S&P 500 versus its historical value. We can start by looking at this chart:

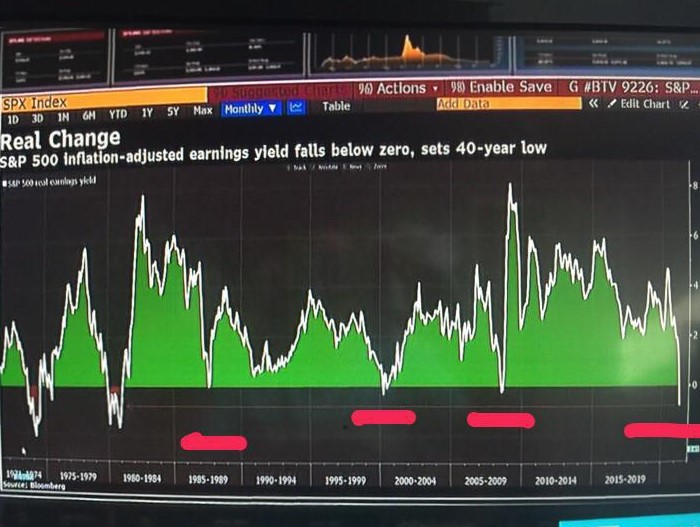

s&pvsearnbloomberg

This screen capture comes from a Bloomberg TV snip that describes that inflation-adjusted earnings yield for the S&P 500 has fallen below zero. For historical sake, we can see the 4 most recent dips below zero include: 1) Black Monday (Stock Market Crash of 1987), 2) Dot-Com Bubble (Stock Market Crash of 2000), 3) Subprime Crisis (Stock Market Crash of 2008), 4) Today (Stock Market Crash of 2021?). You can view the video for yourself at this link.

At the commenter in the video mentions, simplistically, this means that stocks are pretty expensive because we are getting negative yields.

As a reminder, we can look to investopedia for what is inflation-adjusted return:

The inflation-adjusted return is the measure of return that takes into account the time period’s inflation rate. The purpose of the inflation-adjusted return metric is to reveal the return on an investment after removing the effects of inflation. Removing the effects of inflation from the return of an investment allows the investor to see the true earning potential of the security without external economic forces. The inflation-adjusted return is also known as the real rate of return.

The real yield of an investment isn’t the only consideration or, sometimes, even the primary consideration. Investors also need to focus as well on other considerations, including their long-term goals, the duration of their investment horizon, and their risk tolerance. In all cases, it’s important to be aware of the impact inflation is having on your investment returns. When evaluating an investment, be sure to consider its real return and real yield, rather than simply looking at its nominal return or nominal yield, Keeping this in mind will help you manage the purchasing power of your savings.

The people at Crescat Capital have created a detailed letter to their Investors, which is linked here.

This quote below is taken directly from their letter:

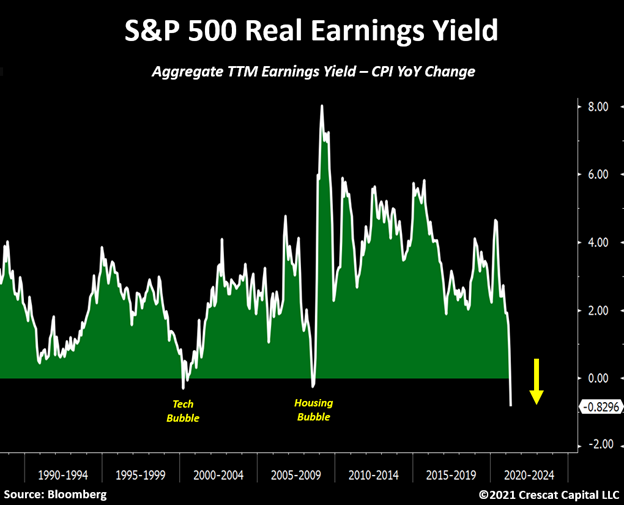

Real Yields Are What Matter

As stimulative packages become exponentially larger in size, the curve of efficacy for monetary policy is peaking. We believe the Fed stimulus is transitioning from a diminishing return phase to a negative one. The scarcity of financial assets yielding anything in real terms is creating a vigorous capital flow dynamic that is incredibly attractive for undervalued tangible assets. With growing concerns of monetary debasement emerging, investors continue to bid up commodity prices, leading to higher consumer prices. This should start becoming an issue for equity markets at excessive valuations yielding less than inflation. For instance, the S&P 500 earnings yield adjusted for CPI is now at its most negative level in 30 years. It is likely much worse, because this is using what we strongly believe is an understated measure of true inflation. Monetary dilution can only lead to higher financial asset prices until inflation begins to develop. At that point, as capital cost rises, Fed’s policies become counterproductive, and a price reset for historically overvalued assets is needed.

Crescat Real Yield

So, what does this all mean? My interpretation is that the US monetary policy is having a huge effect across the US economy. Inflation is a real concern. Zero interest rates and unlimited quantitative easing are reaching the point of diminishing returns and this is being seen across a wide spectrum of different macroeconomic factors that were called out in the Crescat letter.

Now, more than ever, we need to look at your real ROI to ensure that your investment decisions are accounting for a devaluation of the US dollar, in addition to a market correction across a broad spectrum of asset classes, including stock equities, bonds, cryptocurrencies, and even real estate.

Let’s discuss your plan. Schedule a FREE appointment here: