What is DRS?

Do you actually own your stock? Think about your car or your house, if you own it, don’t you have a piece of paper with your name on it that declares your ownership? That debate is the underlying theme in the recent furor around the Direct Registration System (DRS) for stocks. This post is going to explain what is DRS and why it matters to your portfolio.

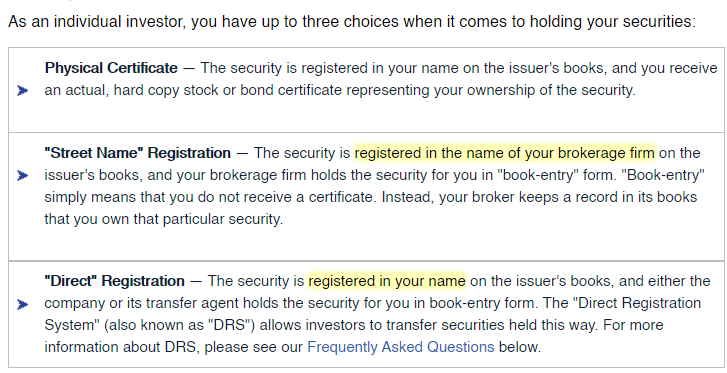

New investors often invest in stocks through a brokerage account. Your shares of stock are registered in a street name when you place a trade order and the stock appears in your account. But investors became concerned about getting their portfolios if their brokers went under. The DRS was created in 1996 for those who didn’t want their stock registered in the name of their firm. This gave investors many options. They could buy or sell from the transfer agent. They could work with their favorite stockbroker to arrange trades through the DRS. Or they could work only through their broker.

For example, you could be the owner of your 1,000 shares of Apple, but Schwab would be the owner of record. Schwab then breaks down which client owns what shares within its own accounting and database. It provides trade confirmations, brokerage statements, and tax records. In the case of margin accounts, you’re left holding the bag with a general claim against the firm if the firm goes bankrupt. What happens to your shares that were held in a street name? This hasn’t been a problem to date, but there’s been a widespread issue that costs many investors a lot of money every few decades. You may have to rely on Securities Investor Protection Corporation (SIPC) insurance if there’s a shortfall. This option has its limits. But between asset segregation and SIPC insurance, it’s been very rare for a customer to fail to get their portfolio back in the event of a brokerage bankruptcy. The Direct Registration System provides an extra safeguard.

The act of Direct Registering Shares (DRS) is taking a security and registering that security in your name which is then held on the books of the transfer agent or the company.

DRS is better than having “Street Name” Registration, which is where the security you buy through Fidelity/TD Ameritrade/Webull is under their name and held on their books. If the float of GameStop is “Street Name” registered, then:

-

It allows brokers to trade with one another in ex-clearing for these securities and produce fails on their books. They have a massive pool of float to borrow from to give you “shares” in your account and they can continue to “reasonably locate” shares to reset their fails.

-

The brokers don’t have to purchase a share on the market when you send a buy order. If they can “reasonably locate” a share due to the float not being locked up, then they can essentially give you an IOU.

-

It allows shorters to continue to borrow from a massive pool of float and short the stock because they can “reasonably locate” shares, even if there is a plethora of phantom shares in existence. To the DTCC and the broker dealers, the shares are there and available!

-

As long as a massive portion of the float stays “Street Name” Registered, the float isn’t locked up and they can continue to stall the game, dragging the price.

The good news is that Direct Registering of Shares is a process that is provided through “transfer agents” for companies. So, it’s possible for retail to register the shares in their name and chunk down the float.

https://www.securitieslawyer101.com/2017/transfer-agent-direct-registration-system-drs/

In fact, that is the ONLY way to DRS. It must be from the designated transfer agent of the company.

Using a DRS provides you with protection against counter party risk. You’re going to have to go through the recovery process through SIPC insurance if your stockbroker goes bankrupt, and if your shares were held in a street name. But you’ll hopefully receive a reimbursement. Stockbrokers are famous for being slow when it comes to delivering annual reports, 10k filings, and proxy statements, from the companies of which you own shares. But the documents are mailed to your address of record, often promptly, when you’re registered directly with the transfer agent through the DRS. Paper stocks can be misplaced, stolen, or destroyed. This is a problem you’ll never have to face with the DRS. This can save you money. You’re advised to insure your stocks for as much as 5% of the market value when you mail stock certificates. This 3% comes out of your pocket. It’s the cost estimate of what the transfer agent will charge to replace them.

Your broker can lend your shares to short sellers when you hold stock in a street name. Short sellers can drive down the price by selling short the stock, selling a borrowed stock, then buying it back cheaper. This results in a profit for the short seller. It can lead to a tax problem when the dividends you receive are technically taken away from you. The short sellers will reimburse you with something known as a payment in lieu of dividends. Your dividends won’t meet the qualified dividend requirements for tax purposes, increasing your taxes on loaned shares. Many companies offer dividend reinvestment programs (DRIPs). These are great if you want to reinvest your dividends by buying more shares of stock with little to no costs or fees. Reinvesting your dividends can have a great effect on your wealth over time. You can make a phone call or send in a signature. You can then enroll in the DRIP when you use the DRS. As an added bonus, you can often gift shares to family or friends by having the transfer agent set up a DRIP account for them. It would be funded with a transfer of shares from your account into theirs. This can be a great option if you’ve built up a large position in a company and you want to give shares up to the gift tax limit exclusion each year.

The biggest disadvantage of using the DRS is that you can’t sell your stock right away. You have to submit instructions to the transfer agent, who then pools your sell orders with those of other sellers. They then execute the trade on a preset schedule. This would prevent you from selling shares in the midst of panic if the world fell apart, or if you needed money right away. At best, you’d have to allow for many business days before you could access your cash. Another somewhat quicker option is to have the transfer agent who’s managing your DRS entry move your shares to the brokerage firm. The stockbroker can then sell them fast. But even this would take at least a few business days. In some cases, it might take even longer.

Now that you know what is DRS, is it right for YOU? If you aren’t sure, schedule a FREE consultation with us and get the answers for yourself. Click here!