Futures

With us discussing total return swaps and portfolio swaps last time, we can discover additional components of the current situation, as described by u/criand here. In this post, we will summarize how futures also play a part in the price movement we see on meme stocks and what that could mean in the upcoming weeks.

Both Options and Futures are derivatives. You can essentially think of them as a side bet of an underlying asset.

An options contract does not require the purchase or sale of the underlying asset. While futures contracts do require the purchase or sale of the underlying asset.

An options contract gives an investor the right, but not the obligation, to buy (or sell) shares at a specific price at any time, as long as the contract is in effect.

By contrast, a futures contract requires a buyer to purchase shares—and a seller to sell them—on a specific future date, unless the holder’s position is closed before the expiration date. – Source

And you can get futures contracts for Equity Indexes. Or in other words you can get future contracts on “baskets” of stocks.

Equity Index Futures are derivatives instruments that give investors exposure to price movements on an underlying Index. Market participants therefore can profit from the price movements of a basket of equities without trading the individual constituents. An index futures contract gives investors the ability to buy or sell an underlying listed financial instrument at a fixed price on a future date. – Source

When you open up a futures contract, you don’t have to go to initial expiration and be forced to buy/sell. You can essentially “extend” the expiration of the position forward. You still maintain the same position, but your position isn’t completely closed out. This is done by closing the original contract and then opening a newer contract for the exact same underlying asset at the current market price.

This “rolling” of a futures allows you to maintain that same risky position beyond the initial expiration of the contract rather than being forced to close it out by buying/selling the underlying. The “rollover” is typically carried out shortly before expiration of the initial contract. But, by performing this rollover it requires the gain/loss on the original contract to be settled. Essentially a “partial” close-out of the initial contract.

Check out the picture below a chart of roll dates.

https://www.cmegroup.com/trading/equity-index/rolldates.html

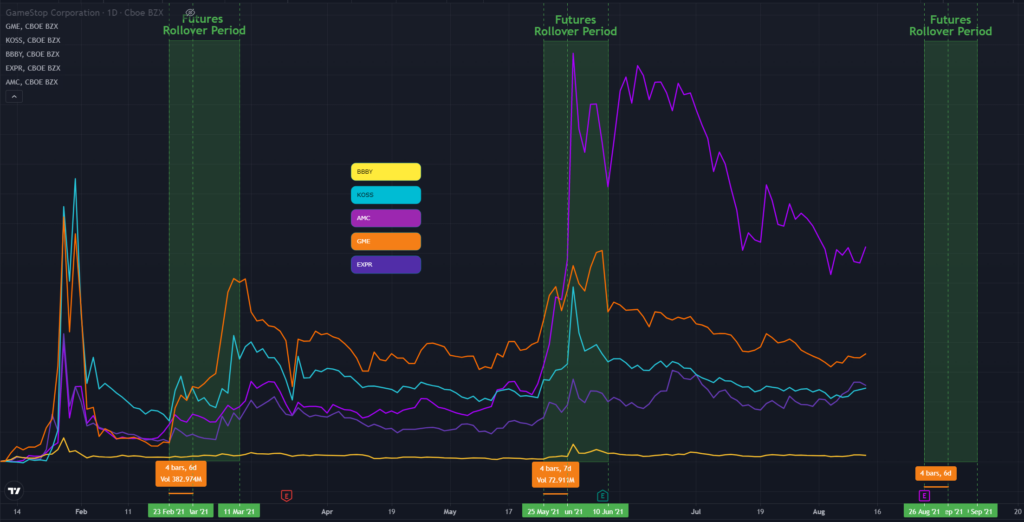

Take another look at the “meme” stock price chart. On there are two dashed green lines marking 3/11/21 and 6/10/21. Huge surges in price occur just before these dates. Afterwards – decay in stock price.

But this does not mean that the futures must be rolled over on those specific dates.

Actually, they can start to be rolled over before these dates within a defined timeframe. The ones circled in the table are basically the “deadline” dates, or the “Last Trading Day” dates.

A futures position must be closed out either before the First Notice Day**, in the case of physically delivered contracts, or before the** Last Trading Day, in the case of cash-settled contracts. The contract is usually closed for cash, and the investor simultaneously enters into the same futures contract trade with a later expiry date. – Source

So, the timeframe where rollouts can start is on of just before the “First Notice Day”. Which is defined as follows:

A First Notice Day (FND) is the day after which an investor who has purchased a futures contract may be required to take physical delivery of the contract’s underlying commodity. The first notice day can vary by contract and will also depends on exchange rules.

If the first business day of the delivery month was Monday, Oct. 1, first notice day would typically fall one to three business days prior, so it could be Wednesday, Sept. 26, Thursday, Sept.27, or Friday, Sept. 28. Most investors close out their positions before first notice day because they don’t want to own physical commodities. According to CME Group, only approximately 2.5% of futures contracts actually go to physical delivery.

From the above, the “First Notice Day” is typically three business days prior to the first business day of the month of settlement. And in some cases, rollovers occur one business day prior to that, coming out to be four business days total.

Which gives us these as possible “rollover” timeframes:

| Futures Expiration Date | First Notice Day (T-3 from first business day of the expiration month) | Day Before First Notice Day (Some rollovers occur starting here) | Last Trading Day / Roll Date | “Rollover Period” (Timeframe where Equity Indexes are rolled) |

|---|---|---|---|---|

| March 19 | February 24 | February 23 | March 11 | February 23 – March 11 |

| June 18 | May 26 | May 25 | June 10 | May 25 – June 10 |

| September 17 | August 27 | August 26 | September 9 | August 26 – September 9 |

Compare this to the “meme” basket charts and some trends begin to develop.

Equity Index Rollover Periods And Price Movements

This leaves us all with a lot of questions. However, the good people of Reddit are on the case and digging through all of the fake news in order to try to discover the truth. These theories may wind up to be incorrect but I think we can all feel that there is something wrong or malicious in the stock market. And the only way to get rid of the bad elements is to expose them to the light.

If you want to know more, feel free to set up a meeting with us by clicking here.