Total Return Swaps

In our last post, we revisited the 2008 Financial Crisis. The dedication and quality of the “meme” Reddit community has continued to amaze all observers and the topic for this post discusses how institutions have evolved past the instruments used in 2008, to new derivatives, such as total return swaps (TRS). The fact that we see that word “swaps” again should be an alarm bell for all of us. We are using material from Reddit for for this blog post.

From Investopedia:

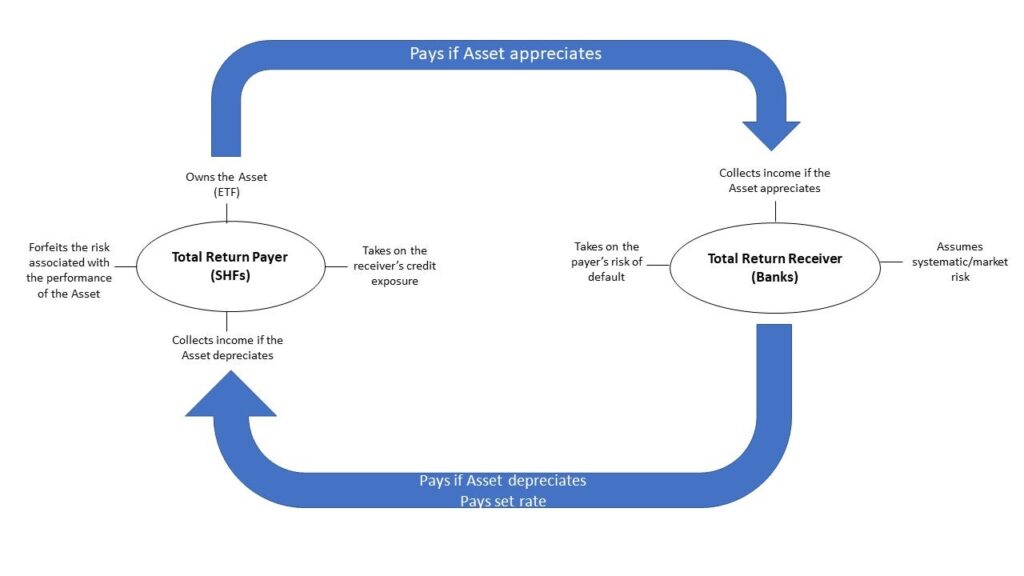

A total return swap is a swap agreement in which one party makes payments based on a set rate, either fixed or variable, while the other party makes payments based on the return of an underlying asset. The underlying asset is usually an equity index, a basket of loans, or bonds. The asset is owned by the party receiving the set rate payment.

-

In a total return swap, one party makes payments according to a set rate, while another party makes payments based on the rate of an underlying or reference asset.

-

Total return swaps permit the party receiving the total return to benefit from the reference asset without owning it.

-

The receiving party also collects any income generated by the asset but, in exchange, must pay a set rate over the life of the swap.

-

The receiver assumes systematic and credit risks, whereas the payer assumes no performance risk but takes on the credit exposure the receiver may be subject to.

Check out this image for a visual representation.

Total Return Swap

The thing with Equity Total Return Swaps is that it’s a type of derivative that, essentially, allows naked shorting. It’s not an uncommon derivative either – it’s a very popular instrument used by Hedge Funds which has blown up in popularity over the past decade.

There’s actually a term for this type of exposure. And it’ll probably piss you off. It’s called a “synthetic prime brokerage” because of how you’re borrowing the prime broker’s benefits.

https://www.hedgeweek.com/2005/09/08/equity-swaps-alternative-trading-equities

The way that it allows naked shorting is because the Hedge Fund “borrows” prime brokerage privileges through the swap. The Hedge Fund is not short on its balance sheet but they are effectively short through the exposure of the derivative. The counterparty of the swap is the one who is short the underlying. But, because the broker dealer can short for the sake of liquidity, they do not need to report short interest on the stock by internalizing the orders and selling against their own “inventory”.

The Hedge Funds can enter into many of these swaps and get short exposure to the stock without directly shorting it. They can enter into tons of these swaps and create tons of synthetic shares without ever worrying about the short interest being reported.

This doesn’t come without risk however. The liability of locating the share for the short position is now on the counterparty rather than the Hedge Fund.

What happens from the start:

-

The Hedge Fund opens a Equity Total Return Swap with a counterparty.

-

The counterparty is the one with the short position on their balance sheet. SI is not reported due to broker dealer privileges.

-

The Hedge Fund gets returns if the stock goes down.

-

The Hedge Fund will go under if the stock shoots up in price too much. They’re not short on their balance sheet but they are short the swap.

-

If the Counterparty did not hedge the position, the counterparty is on the hook to buy up shares that were shorted.

-

If Equity Total Return Swaps were abused to add too many synthetics to the share pool, and a short squeeze play occurs, the counterparty is absolutely screwed.

This explanation on Total Return Swaps is setting up for more explanation on why the next crash will occur. Set up a FREE consultation with us by clicking here. Protect your portfolio before that crashes as well.

[…] that we have discussed Total Return Swaps in our last post, we can go further down the rabbit hole and evaluate Portfolio Swaps and how they pertain to our […]