Trouble is Brewing

Since the beginning of March 2021, the NSCC and DTCC have been swiftly proposing and approving a flurry of amendments to their rules. I’ll link the appropriate documents and paths below but after reading the proposed amendments, it is clear that the these changes are designed to close loopholes and clarify who is responsible in case of a market meltdown. From an outside perspective, it looks like regulators have become aware of the instability of the U.S. markets and are trying to clean up an absolute mess with these amendments. In short, trouble is brewing.

For those unaware:

Definitions:

-

NSCC – The National Securities Clearing Corporation provides clearing, settlement, risk management, central counterparty services and a guarantee of completion for certain transactions for virtually all broker-to-broker trades involving equities, corporate and municipal debt, American depositary receipts, exchange-traded funds, and unit investment trusts.

-

DTCC – The Depository Trust & Clearing Corporation is the post-trade financial services company providing clearing and settlement services to the financial markets.

The amendments in question can be found here on the DTCC website.

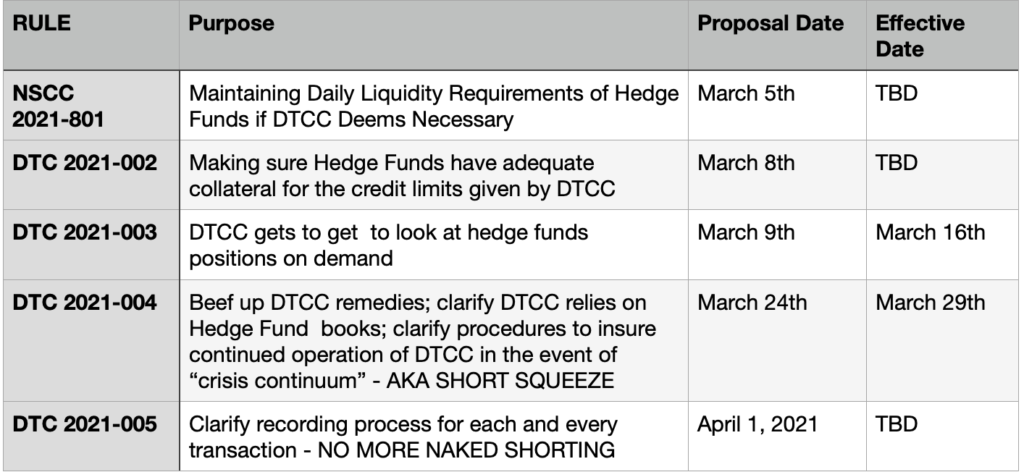

However to summarize for those reading here, look at the below chart:

Offhand, these changes seem well past due because simplistically, if you are exchanging assets through the DTCC, you should 1) have to own the asset you are pledging and 2) once the asset has been pledged, the same asset should not be able to be pledged to someone else.

To compare the US market to others, we only need to look at the European market. Since 2008 the European Markets (“EM”) restricted and even banned short selling altogether (see link). However, EM found it difficult to impose bans on short selling altogether due to varying rules and regulations across the various countries on the European continent. Therefore as a way to safeguard the EM from abusive short selling EM adopted rules in 2012, that (1) increased transparency by requiring short sellers to declare their short positions; (2) gave regulators the power to stop the shorting selling of an asset in exceptional circumstances; and (3) established a centralized clearing service to ensure assets that were shorted could be purchased and a system to remedy failure to delivers.

Second and probably most significantly in March of 2020 EM began heavily restricting and evening banning short selling of assets to minimize risk of increased volatility and concerns about market confidence caused by the Coronavirus Pandemic. Much of those restrictions were lifted in June of 2020, but many countries in the EU continued short selling restrictions and bans through 2020 and into 2021. Even now, the EM has imposed greater reporting requirements to protect their markets from the volatility of short selling.

US regulators have failed to assess and manage the risk of short selling to a reckless degree. Combine the reckless lack of oversight with the free money that is being printed and funneled to hedge funds. This has enabled them to take insane risk by over-leveraging their positions and trading and selling assets they don’t own. In other words, trouble is brewing.

If YOU want to figure out what you can do with your investments, schedule a FREE consultation with us here.