Institutional Ownership

Institutional investors are known to improve price discovery, increase allocative efficiency, and promote management accountability. They aggregate the capital that businesses need to grow, and provide trading markets with liquidity – the lifeblood of our capital markets. In this post, we will review the specifics of what is institutional ownership and how this brings up interesting questions when we look at specific stocks like GameStop.

Check out this link for the full definition but I’ll try to capture the highlights here:

What Is Institutional Ownership?

Institutional ownership is the amount of a company’s available stock owned by mutual or pension funds, insurance companies, investment firms, private foundations, endowments or other large entities that manage funds on behalf of others.

Understanding Institutional Ownership

Stocks with a large amount of institutional ownership are often looked upon favorably. Large entities frequently employ a team of analysts to perform detailed and expensive financial research before the group purchases a large block of a company’s stock. This makes their decisions influential in the eyes of other potential investors.

How Institutional Ownership Can Influence the Value of Securities

Because of the investment made in research, institutions are not quick to sell their positions. When they do, however, it can be seen as a judgment on the stock’s value and drive down its price.

Given the way institutions tend to approach stock ownership, by taking the time to accumulate the number of shares desired for its position, they might also react collectively to significant news. Not only will the trading activity be followed by retail investors, but other institutional investors might also retreat from a stock en masse if significant issues are discovered. Such a move could trigger a sell-off as the lack of institutional investor confidence weakens the security’s value.

Institutions may also work to drive the share price higher once they own the stock. TV appearances, articles in high-profile publications and presentations at investor conferences help to move the stock higher, increasing the value of the position.

The reputation of institutional owners can also influence whether analysts and fund managers at other institutions are interested in buying that stock. For example, if a firm is well-known as a momentum investor, some fund managers may shy away from buying stock heavily owned by that institution. However, if a firm has a reputation for choosing stocks that perform well over the long term, fund managers may be more likely to buy stock that is heavily invested in by that firm.

Issues With Institutional Ownership

When institutions represent the majority of ownership in a given security, there can be a number of issues that arise. With the resources available to institutions, it could be possible for nearly all outstanding shares of a security to be acquired and controlled by these entities, including borrowed shares that short sellers were using to bet against the stock. Such a concentration of ownership may lead to peak ownership where there is little room for new retail investors or any significant trading activity.

Furthermore, peak ownership can mean there will be no further significant investments by institutions into the security, which may lead to diminished upside potential for the stock. There may be discussions of the security’s worth based on the operations of the associated company. With a significant portion of shares locked up in institutional ownership, there may be little opportunity for further investment.

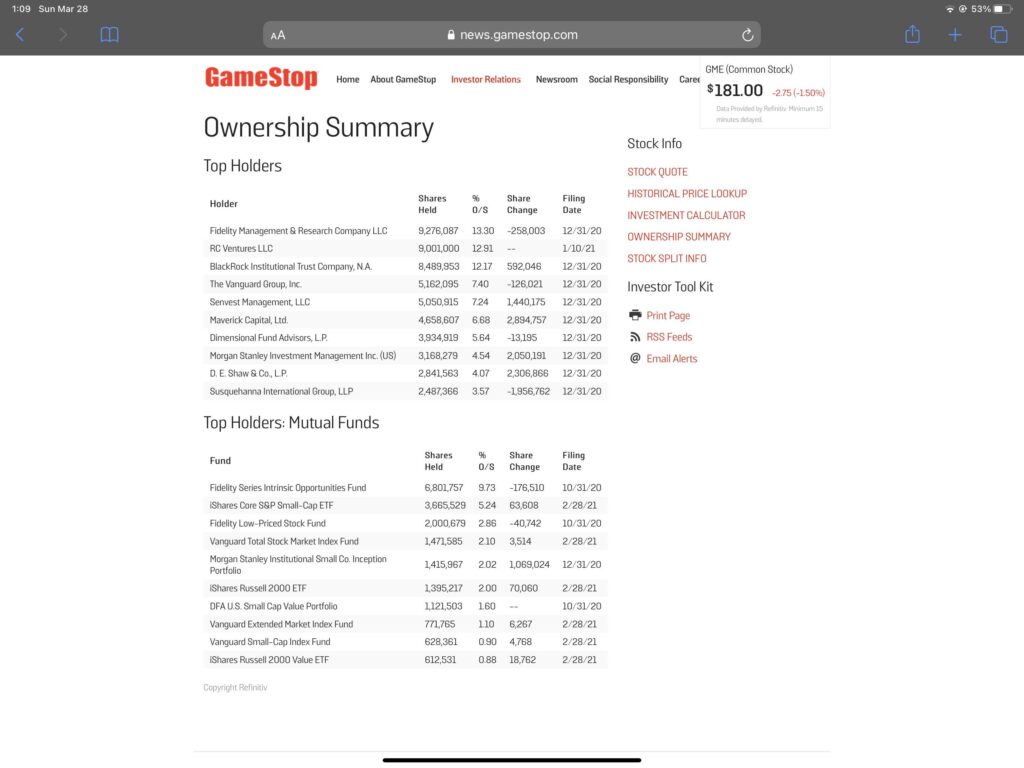

GameStop Institutional Ownership (https://news.gamestop.com/stock-information/institutional-ownership)

On the surface, this doesn’t look too out of the norm. It appears there are several institutions that have decided to invest in GameStop. Compare it to NASDAQ’s website and we see:

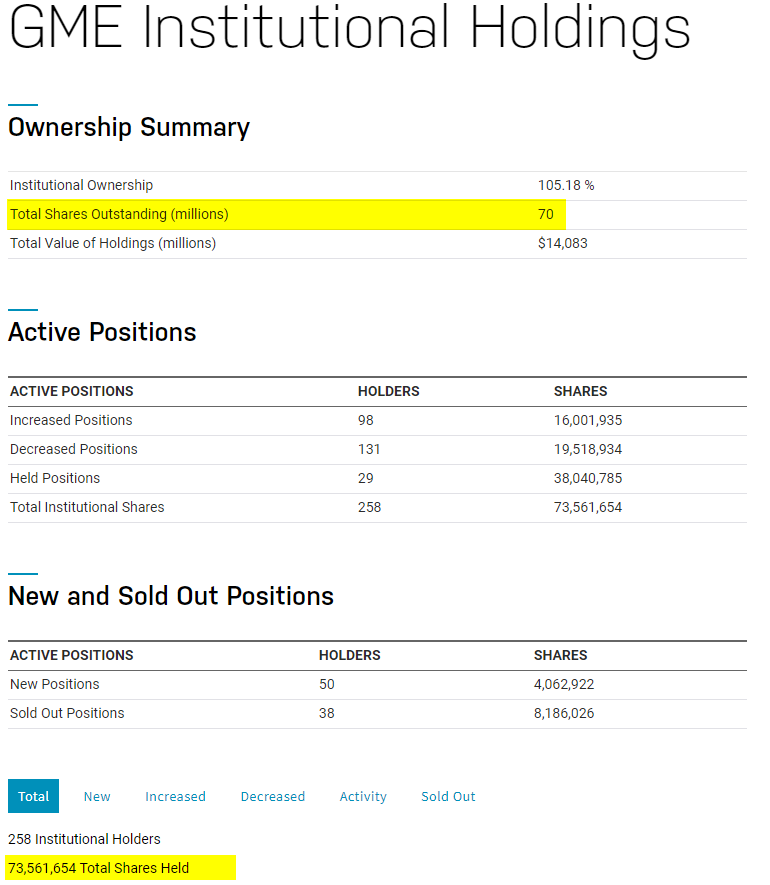

Well, now that’s interesting, 73.5 million shares owned by institutional owners while there are 70 million shares outstanding. And this doesn’t even take into the fact that there are a lot more people holding GameStop shares than institutions including Insiders (Company Employees), Retail/Individuals, and Pension Funds, just to name a few. It raises the question behind the crux of the GameStop phenomenon; who really has shares and just how many of them exist? This also explains why understanding institutional ownership is critical to understanding the situation we are currently seeing with GameStop.

Schedule a FREE consultation here and let us teach you how to identify these types of inconsistencies as you do your own due diligence in the stock market.