How the CARES Act impacts our Future

As a result of the Covid 19 virus, the US government has passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This provides $1.8 trillion in direct aid to individuals and businesses, the largest stimulus package in US history. The need for this aid is not in dispute. This post just tries to figure out what are the long term ramifications and how the CARES Act impacts our future.

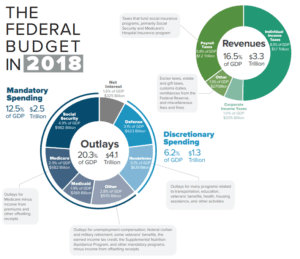

In 2018 (attached picture), the federal spending was $4.1 trillion and revenues were $3.3 trillion. In 2019, federal spending was $4.4 trillion and revenues were $3.5 trillion. Obviously, before the pandemic, the government was already spending more than they took in.

Looking at the 2018 pie chart for revenues, we see that about 50% of revenue ($1.7 trillion) came from Individual Income Taxes. About another 30% of revenue ($1.2 trillion) came from Payroll Taxes. Corporate Income taxes were $205 billion. There is also an Other bucket that includes gift taxes, tariffs, etc.

In 2018, that means that roughly 80% of the government’s revenue came from their greatest asset, this is YOU (the individual).

Sure, a lot of people say that we should just double corporate taxes. But think about, if I double $205 billion, that is just $410 billion. A relative drop in the bucket for what the shortfall is.

For me, this only means that for this big of a budget deficit, the way that gets the most revenue is to increase revenue from the individual. This can only mean more taxes! This is how the CARES Act impacts our future.

If you want to know how to minimize this impact to YOUR finances, set up a FREE consultation by clicking on the link: https://www.successoptionsgroup.com/contact/booking-form/