Hidden Costs

Your broker is probably providing you commission free trades as part of your account with them. In this post, we are going to look at the hidden costs behind what “free” commissions really get you.

Since 2000, the Securities and Exchange Commission has required brokerage firms to file a quarterly report showing where they are routing their stock trades for execution. The filing is known as a 606 report after Rule 606 of Regulation NMS (National Market System). Because so many traders at Reddit’s WallStreetBets’ message board have focused on the fact that billionaire Ken Griffin’s Citadel Securities was executing the majority of trades for Robinhood, the trading app where a lot of the Redditors directed their GameStop trades, let’s take a look at what other online brokers might have also been directing GameStop trades to Citadel Securities.

According to the 606 reports for the fourth quarter of 2020 for the following nine online brokers, Citadel was providing payment-for-order-flow (giving a cash rebate for trade orders directed to it) to each of the following: Robinhood, E-Trade, TD Ameritrade, Charles Schwab, WeBull, Ally Invest Securities, First Trade and TradeStation. At Fidelity Brokerage Services, it was directing stock and option orders to Citadel Securities but was only receiving payment-for-order-flow on the option orders, according to its 606 report.

According to these 606 reports, Citadel ranked as the number one venue for sending both stock and option orders at the following firms: Robinhood, TD Ameritrade, Charles Schwab, WeBull, Fidelity Brokerage Services and Ally Invest Securities. Citadel was the number one venue for options trades by E-Trade while ranking lower for stock trades. At First Trade and TradeStation, Citadel ranked number one for market orders for stocks (trades with no stated price limit) and number one for options.

The bottom line here: there was a high probability that no matter what online brokerage firm Redditors sent their GameStop orders to initially, Ken Griffin’s Citadel Securities was getting a piece of the action in the end. According to the website of Citadel Securities, “To maximize trading opportunities for clients, our automated trading platform sources liquidity from all U.S. exchanges and more than 18 alternative liquidity venues.”

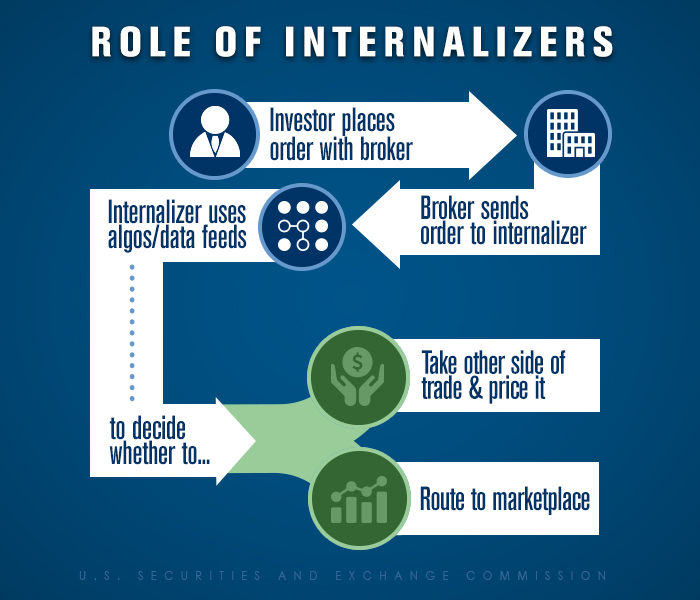

For those liking a visual, see the below diagram for what Citadel Securities provides as an Internalizer.

In Payment For Order Flow (PFOF), your order is sent from whatever discount brokerage you’re using to Citadel Securities, who decides to either: A) pass your order onto the open market, where we watch a little green and red candles jump around or B) to take the other side of your order (short whatever you long, or long whatever you short) at which point the life of your order ends, never making it to the open market.

Yup, when you use a discount brokerage like Robinhood, your order may never land on the open market. But this is fine right?… Well let’s imagine that there’s only one monopolistic internalizer trading a security, and that internalizer is internalizing all the retail volume trying to buy a security. Even if millions of retail traders are buying the security, the stock price on the open market wouldn’t move, there would be no volume on the open market, and the internalizer would have a massive short position on the stock that they have to unload. What this looks like in the world of green and red candles is a massive bull flag while the internalizer is internalizing and massive upward breakouts when the internalizer unloads their short position.

Hopefully this is information that can provide you more background on the hidden costs behind “free” commissions and trading. Now, what does that mean for you right now? Well, nothing really but just realize that like most of us know already, nothing in life is “free”.

Schedule a FREE consultation with us here and let’s figure out how YOU can avoid these hidden traps in the stock market.