Flight-to-Quality

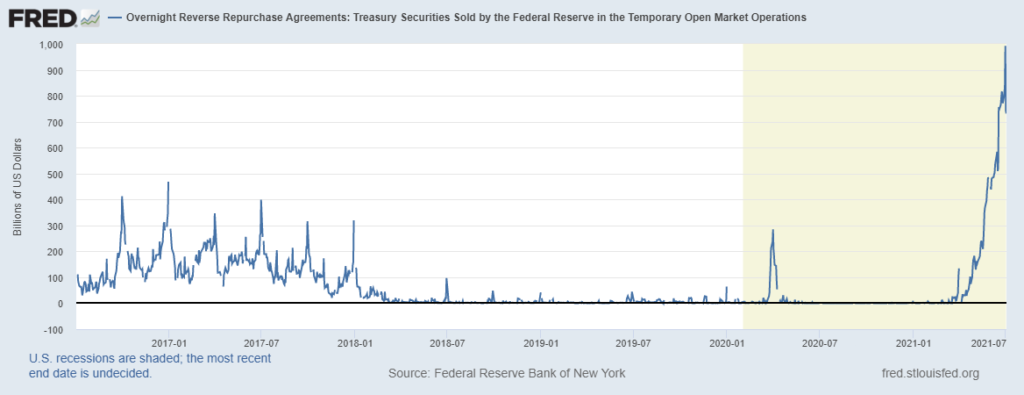

In our prior post, we introduced the concept of overnight reverse repurchase agreements (ON RRP). The number continues to rise each day and what is appears we are seeing is a flight-to-quality by the major US banks.

The Federal Reserve is the bank for the US banks. Their job is to make sure the US dollar remains valuable and the US economy works in such a way that it supports the dollar. Some will argue the nuance here. That means the primary goal is to keep long-term inflation down.

The Fed has 2 tools to control inflation and keep the US dollar valuable: Federal Funds Rate (FFR) and Overnight Reverse Repurchase agreements (ON RRP).

The FFR is the interest rate banks should lend to each other, and is set by the FOMC (essentially the Fed). This is the interest rate banks pay to each other to loan money to each other.

The ON RRP is when the Fed removes cash from the market in exchange for something else, in this case US Treasuries.

I’ve updated the below graph with the most recent chart (7-5-21):

Why do banks loan money to each other anyway?

They loan money overnight to help each other have enough liquidity to satisfy the fractional-reserve banking law. This law means you must have some percent of the money you hold in cash in an account with the Federal Reserve bank. The law states that you must satisfy an average amount of a 2-week average of overnight reserve. If you have a lot of clients that take money out of your bank today it can add up quick. In order to be a bank you must comply to regulations around fractional reserves, or how much money you keep in an account with the Fed. The Fed holds fractional reserve accounts for all banks in the US. Fractional reserves are the idea that if you have a bad day on the market, or something tragic happens you should be able to survive. In the past, the US has been criticized for having too low of a reserve rate compared to more conservative banks, for instance the Bank of Canada.

An example:

– You receive $1bn from deposits on Monday

– You lend 90% of that $1bn on Tuesday to a prime broker (usually a subsidiary of your bank – they lend that out to other people like hedge funds and so on)

– On Wednesday your clients withdraw a net of $80million, but you only kept $100 million – so you now have $20 million dollars in cash. In order to comply to regulation you must find ($700 * 10%) – $20 million. You must come up with $50 million dollars tonight so that you don’t violate the law.

– On Wednesday another bank had a net surplus of $100 million dollars, and they can’t really make much money on it unless they re-invest it. We’ve got a deal! Other bank loans you $50 million dollars at a rate close to the Federal Funds Rate (FFR).

– Other bank makes $50 million * (FFR%), and you get to keep being a bank.

This happens every night, with every bank – they all have ebbs and flows of cash, and they all need to remain liquid such that when you go to an ATM you can actually take your cash out – and so that they don’t get denied their bank status and go out of business.

How does the Federal Funds Rate (FFR) affect inflation?

Supply and demand! If something is “hard to borrow” it effectively means there is less of it – it’s the same thing with respect to lending, that’s why it’s referred to as the money “supply” not volume of dollars.

The lower FFR is the “easier to borrow” money is – meaning money worth less. When money is worth less, that means inflation is going up.

The higher the FFR is the “harder to borrow” money is – meaning money is worth more. When money is worth more, inflation is going down.

Prime rates, mortgages, car loans – virtually all lending rates depend on this supply / demand of money and therefore are all dependent on the FFR. That’s why rates are sometimes described as (prime + x%) – because prime is what prime brokers will lend depending on the FFR. During the pandemic the FFR was effectively 0%. This allowed a lot of folks to get mortgages they may not actually be able to afford, in addition to some other really band lending that I will explain later.

How does the Overnight Reverse Repurchase Agreement (ON RRP) affect inflation?

A similar relationship exists for the ON RRP.

The more cash in the market, the less cash is worth, inflation goes up.

The less cash in the market, the more cash is worth and inflation goes down.

The ON RRP allows the Fed to take cash out of the market. The ON RRP happens every night, and if it stays high – it’s kind of like a permanent withdrawal of the funds from the market. Right now, essentially the Fed is taking out $500bn from the market. This is supposed to be “temporarily” until the market catches up with the cash flow. Critics of the ON RRP say that the Fed should limit it’s use because it can negatively affect participants.

– The Fed controls when to unwind the cash-flow and therefore can determine who is best positioned to take advantage of it when they do

– The Fed becomes entangle with the free market operations, making them a giant crutch for private entities that will no longer adhere to capitalisms laws (too big to fail mentality). Private entities who are not afraid to fail will gamble and gamble big. Sound familiar?

A phenomenon called “flight-to-quality”

This phenomenon can occur with the Fed performing ON RRP because participants will prefer to do business with another entity of high quality. What makes an entity high quality?

– They give you good rates

– They give you good collateral

– They don’t default with your cash on hand

When the Fed goes into the market as a large borrower of cash – they become the highest quality lender that one can find. They give great assets US Treasuries. They cannot default. The only thing is that they are giving shitty interest rates, but who cares. If banks are worried about short-term stability they are not thinking about interest rates, they are thinking:

– How do I get out of this with out my money going down with another ship, i.e. without lending it to another bank because who knows what kind of shitty deals they made. Look at the ones I made! Holy fuck, Fed let me in!

– How do I get enough assets to leverage for my own (nefarious) purposes. More below!

Banks will choose to do dealings increasingly with the Fed, and less and less with each other. This is not a free market and it can have some very bad outcomes.

The Fed is taking cash out of the market to prevent inflation and prevent economic collapse, since all of the Fed operations are tied to mortgage backed securities and commercial mortgage backed securities as well as the value of the US dollar – they have to act. There is no world today in which the US is prepared to have the USD not back most other currencies in the world. There is no world today the US can reasonably handle another collapse of the MBS or CMBS markets.

– Banks (prime brokers) are taking US treasuries in exchange for their cash because they have too much cash and they over-lent to to participants with an extremely loose FFR. The extremely low rates would allow someone to leverage their assets incredibly high with very little interest or cost – this means 2x effectively cost the same as 20x for interest paid. Banks are now happy to accept US Treasuries on an ongoing basis to satisfy margin and other requirements for their participants to prevent them from being liquidated and taking huge losses. Remember that saying, “You lose $100, its your problem, you lose $100 million dollars it’s your banks problem”

The aftermath of COVID-19 monetary policy

From Feb 2020 until now the Fed loosened monetary policy, lowered the FFR (inflation up!) and printed a lot of money and in my opinion, banks and by extension their prime brokers over-lent to market participants in both the fixed income market (treasuries & MBS) and stock market. The Fed is now stuck doing permanent “temporary” ON RRP’s until the market catches up to the money they printed, or a huge financial event happens.

This does not bode well for us at all. The next question for everybody should be what is your flight-to-quality plan? Let’s figure it out together. Click here.