Financial Market Dominoes

Last week, the DTC, ICC, and OCC continued to pass additional rules that seem to prepare for BIG defaults in the stock market. Big banks are also scheduled to testify later this week on May 26 & 27. This is a possible interpretation of events as discussed by a reddit user u/criand. The original article can be found here. All of it presents a horrifying picture of financial market dominoes where all asset classes will be impacted and one domino may knock down everything else with it.

In summary, the thesis is as follows: The market is an overleveraged and rehypothecated bomb. The banks have been fighting a liquidity/collateral crisis since the end of March due to the government emergency liquidity programs ending and inflation starting to kick in. The repo market could blow up at any moment from a lack of collateral and short squeeze the US Treasury market itself. The entire market is hanging by a thread and the DTC, ICC, and OCC are prepared for the fallout. There are big players in the Crypto market and if they default due to this repo market bomb, massive selloffs can occur, pulling everything down in the stock market, repo market, and crypto market all at once.

The DTC, ICC, and OCC are all major clearing corps of the market. For simplicity, we’ll label them as such:

DTC = stocks

ICC = default swaps

OCC = options

When I say member default, this means that the member defaulted on something – such as their net long and short positions have brought them negative long enough to be margin called and liquidated. Ever hear of banks defaulting in 2008? That means they were about to be wiped from existence, until the Fed stepped in and bailed them out.

The DTC, ICC, and OCC all pretty much share the same members. Market Makers and Banks. Except of course the ICC which only has Banks as members. All three of them have passed similar rules regarding member defaults. The last of which was for the OCC which went into effect as of Wednesday, May 19th.

If a member defaults in the ICC, they most likely default in the DTC and OCC as well. Same relationship the other three ways as well. The DTC, ICC, and OCC do not want to be left paying up for the defaulting member’s debts in the event of a default.

To prepare for the market implosion, the DTC, ICC, and OCC have passed rules/plans to deal with defaulting members.

Every single one of them now has some form of rule which allows the defaulting members assets to be auctioned off and to deal with mass amounts of members defaulting (wind-down plan). This allows other members of the DTC, ICC, or OCC to buy the defaulters assets at a discount while in turn funding the defaulting member’s short positions. This is in place of straight up liquidation on the open market [Note: There is no auction plan for crypto. So straight market orders and liquidation can occur].

The key takeaway is that all three of them, the DTC, ICC, and OCC are ready to pull the plug on Banks, HedgeFunds, Firms, etc. They have been planning for this coming for a while now. The moment a member defaults in the DTC, ICC, or OCC, it will cascade to the other clearing corps and cause them to default over there as well. ALL of the stocks, options, and swaps of defaulting members are up for auction – and liquidation in all other investments occurs.

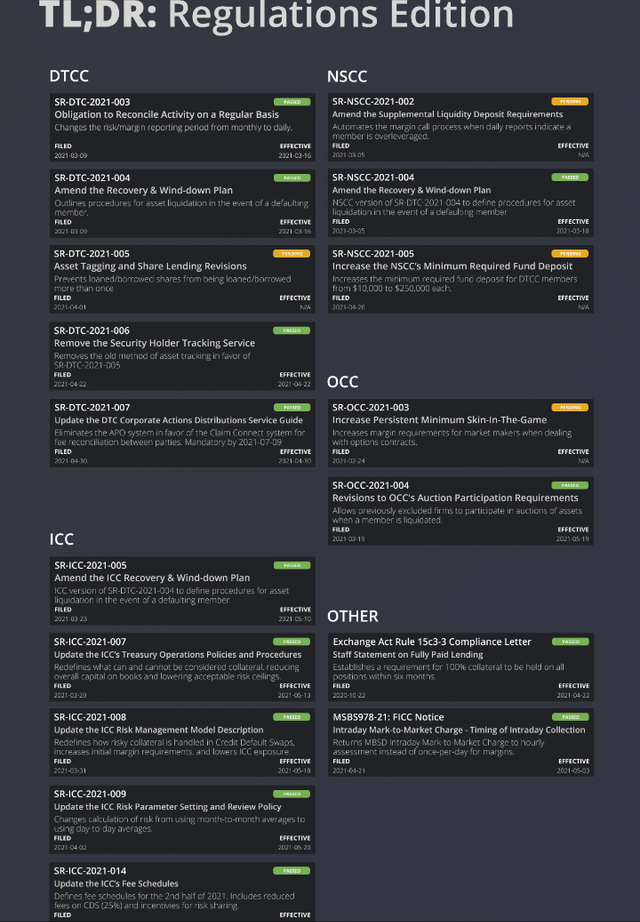

I found a picture of some of the new regulations that have been enacted within the last few months. Many of the filings can be found here (DTC) or here (OCC) or here (ICC).

Rules

Suffice it to say, when government entities start making a bunch of new rules, you know that something fishy is going on. And if we combine this info with the prior posts on the crypto exit and reverse repos, we start building a game of financial market dominoes where one small tap can knock everything down.

Set up a FREE consultation with us if you want to find out how to protect yourself. Click here.