Reddit Army

Perhaps one of the most interesting dynamics to come out of the GameStop event is the discovery by many, including myself, of the power of Reddit and the sheer number of people out there that have knowledge and are willing to share it freely. The so-called Reddit Army is a truly open forum, for the time being, where people genuinely discuss matters of importance. There is a forum for everybody but I’ll admit, I’ve tended to follow the ones most associated the GameStop incident and have now become a part of the Reddit Army myself. Below are some interesting notes that the Reddit Army uncovered concerning GME and the ETF, XRT.

First, let me link an article concerning XRT from The Motley Fool here:

1. SPDR S&P Retail

Easily taking the top spot is SPDR S&P Retail ETF (NYSEMKT:XRT). The ETF had an unbelievable short-interest ratio of 465% recently, with more than 12 million shares short and only 2.6 million outstanding.

The explanation for interest among short-sellers here is even more obvious. The equal-weighted ETF counts GameStop among its holdings. When short-selling investors couldn’t directly borrow GameStop shares, going indirectly through this ETF made a lot more sense. When GameStop’s share price jumped, it briefly made up more than 20% of the ETF’s assets.

The SPDR S&P Retail ETF might seem like a reasonable short candidate given the woes that retailers have had. But the fund is actually up nearly 80% over the past year, as it holds many retailers that actually cashed in on rising demand during the COVID-19 pandemic. More recently, the fund has done what GameStop short-sellers wanted, rising and falling with the shares of the video game retailer. But in a supposedly dying industry, the ETF has done quite well.

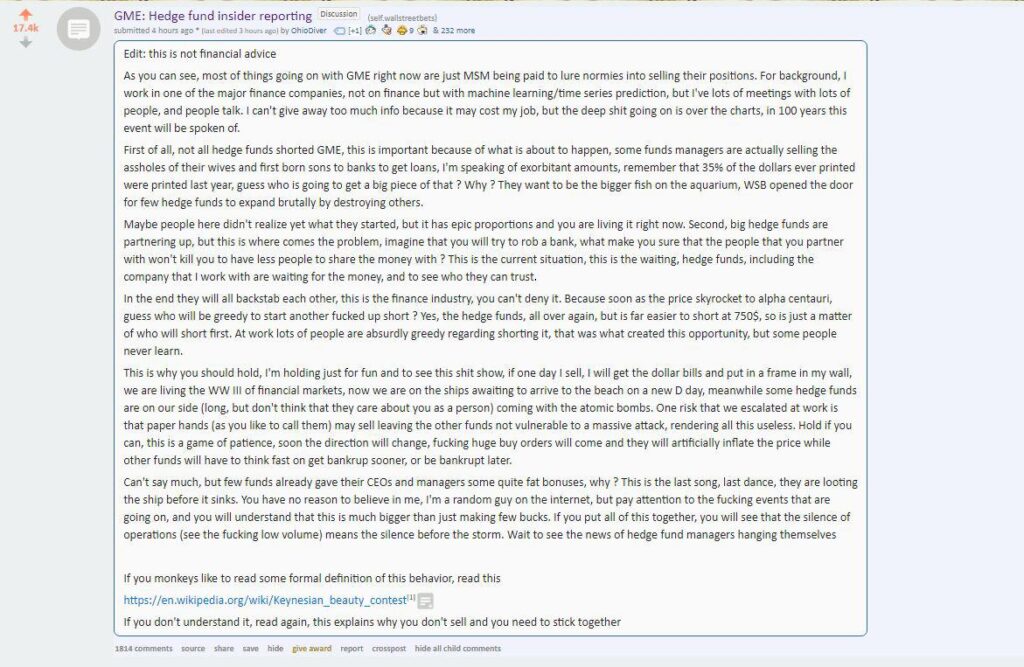

Here are some snippets from the Reddit Army:

“One possibility is that because XRT redemptions are delivered in-kind — meaning that its shares are exchanged for the underlying stocks in the fund –investors are ditching the ETF to get their hands on hard-to-borrow GameStop shares. “

For those that don’t know redemption is when you give your share back to the company that issued it. XRT as it says in the Bloomberg article above will redeem it’s shares by giving you the underlying stocks that make up the share. That’s where the HF’s got – I’m guessing half – of the shares they used to cover their GME fails. The other half they bought from us off the market.

Below is a YouTube link to

ETF Short Interest and Failures-to-Deliver: Naked Short Selling or Operational Shorting?

-

We assumed that GME price fell due to the temporary halt on buying. However, during that time Blackrock and Vanguard and a few others I believe were still letting people buy, but moreso were buying themselves. What other groups were buying at that time?

-

Why would a stock everyone was willing to buy at a high price (I bought some at 315) suddenly go down in price? Everyone knew there were still millions of us willing to pay more, as we are right now.

-

Who wanted the price to go down? (Everyone who had already shorted it)

-

Both GME and XRT continued to be heavily shorted before, during, and after the spike in GME.

-

There is a thing called the uptick rule, which was eliminated in 2007. However in 2010 a new uptick rule was enacted:

“The 2010 alternative uptick rule (Rule 201) allows investors to exit long positions before short selling occurs. The rule is triggered when a stock price falls at least 10% in one day. At that point, short selling is permitted if the price is above the current best bid.” – Investopedia

This is supposed to prevent short sellers from using the practice of shorting to lower the price of a stock intentionally. Guess who is exempt from this rule? ETF’s.

Now if an ETF is shorted to lower it’s own price, and after that is done is redeemed for the underlying shares, can those shares be said to be worth less than the market price of the underlying stock? Can they then be sold at a lower price than market? What if the ETF’s with GME in them were shorted for this purpose and then the XRT was redeemed and the GME in them was sold at below market price, thus driving the price of GME down without breaking any rules? Link

https://en.wikipedia.org/wiki/Keynesian_beauty_contest

More to come but I know am thankful for the Reddit Army.