What is a Reverse Repo?

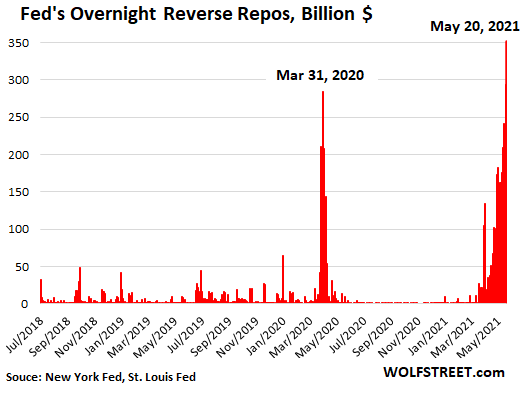

You may or may not be aware but there are MASSIVE amounts of Reverse Repo lending occurring this month (May 2021). Your next question may be what is a reverse repo? And why should I care about it? This post will go through some of the highlights but I encourage you to look deeper into for your own due diligence.

What is a Reverse Repo (RRP)? Investopedia states: “A reverse repurchase agreement (RRP) is an act of buying securities with the intention of returning, or reselling, those same assets back in the future at a profit. This process is the opposite side of the coin to the repurchase agreement.” From the point of view of a bank, this is liquidity draining, since they are using cash reserves to get ahold of treasuries. If you’re still confused on Repos, watch this great WSJ piece here.

Ok, so what does this mean for us? Some of you may not know, but issues were arising with the Repo market as far back as September 2019. Basically, as Wolfstreet states,

“In the fall of 2019, when the repo market blew out, the Fed stepped in and bought Treasury securities and MBS and handed out cash via repurchase agreements. When these repos matured, the Fed got its money back, and the counterparties got their securities back. The Fed also did this during the market rout in March 2020. But by July 2020, the last repos matured and were unwound.

Now the Fed is doing the opposite, with “reverse repos.” Repos are assets on the Fed’s balance sheet. Reverse repos are liabilities. With these reverse repos, the Fed is now massively selling Treasury securities to counterparties and taking their cash, thereby draining liquidity from the market – the opposite effect of QE.

This morning, the Fed sold $351 billion in Treasury securities via overnight reverse repos to 48 counter parties, thereby blowing past the brief spike at the end of March 2020, and more than replacing yesterday’s $294 billion in Treasury securities that it has sold via reverse repos to 43 counterparties and that matured and unwound this morning.”

reverse repo

These reverse repos are a sign that the banking system is struggling to deal with the liquidity that the Fed has been injecting via its QE. And that’s in part why there is now some clamoring on Wall Street for the Fed to taper its QE purchases because the banking system is now drowning in liquidity that banks have as reserves on their balance sheet. By buying Treasuries in the repo market, the banks lower their reserves and increase their Treasury holdings.

On May 21st, reverse repos reached $369B with 52 participants. Just two weeks ago, we had less than half that amount, $155B on May 6th. Simplistically, this means that there is too much cash in the system and not enough collateral (ie. treasury bonds). There is an imbalance between dollars and the asset backing the dollar’s worth. In my opinion, the major causes for this include QE (where too many dollars have been created) and rehypothecation of treasury bonds. In other words, the same treasury bond being lent to A for $10K, who lent it to B for $10K, who lent it to C for $10K, … but there is only 1 treasury bond and now $30K was lent. And now institutions want treasury bonds and not dollars; so much so, that treasury bonds have a negative interest rate (banks and institutions want these treasury bonds so bad that they will pay what’s it worth and pay some more on top of that to get their hands on it).

Unfortunately, for all of us, treasuries are not normal fixed income instruments. They are literally the backbone of the entire financial system. Almost every other price is indirectly derived from treasuries: LIBOR (used for lending), WACC Discount (used to price stocks), ARMs (adjustable rate mortgages), Credit cards, auto loans, venture loans, Lines of Credit, etc etc.

All of this leads to a scary future that signals a market correction across all asset classes. But hopefully, this post helped explain to you what is a reverse repo so you have a better understanding and grounding of this financial instrument.

IF this post got you as worried as I am, please set up a FREE consultation with us here:

[…] our prior post, we introduced the concept of overnight reverse repurchase agreements (ON RRP). The number […]