The Crypto Exit

The volatility in the crypto market is a hotly debated topic from supporters and critics alike. There are many differing opinions on the root cause, ranging from Elon Musk tweets, China, margin debt, etc., but this post will attempt to stick to the facts of the crypto exit. As with all financial matters, it is up to YOU to do your own due diligence and figure out what YOU believe.

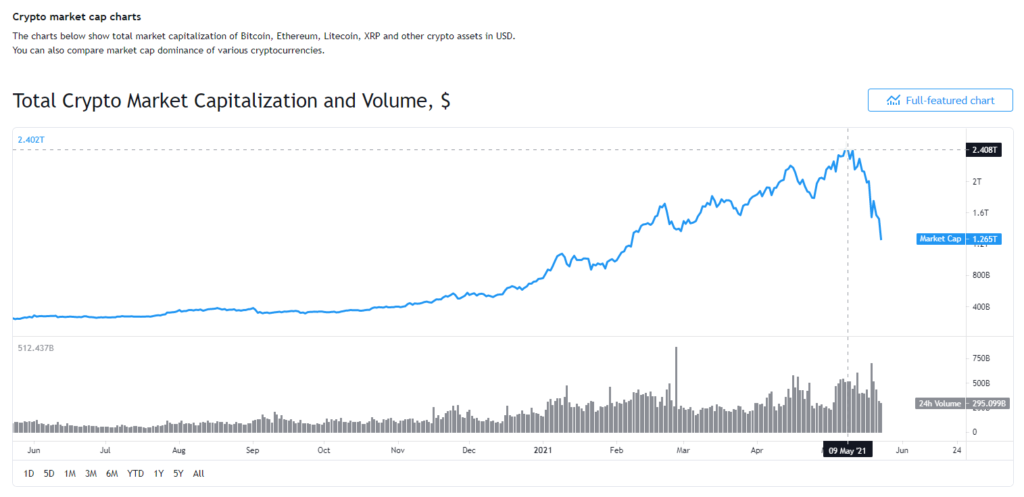

Over the past couple of weeks, the total market cap for crypto has dropped by over $1 trillion dollars. Yes, that is trillion with a “t”. Check out this graph from TradingView (Link).

There was a broad sell-off across all cryptocurrencies. The leading cryptocurrency went from ~$59K to ~$30K, along with all of the other coins. Just as we discussed in a prior post on OBV (link), the fact that I see real volume surrounding the sell-off indicates to me that holders are genuinely exiting their positions with cryptocurrencies.

Market cap isn’t the perfect measure because it takes the current price (or price at a specific point in time), at which price some assets/crypto/stocks were sold and multiplies it by the entire supply. In reality, if every holder was trying to sell at once and at that price point, that value wouldn’t hold and nobody would get filled. However, to me, it is one of the easier indicators to use to indicate the crypto exit and movement out of crypto positions.

Long term, I believe there is value in having a position in cryptocurrencies, as fundamentally, they should be a hedge against fiat currencies, much in the same way as gold or silver. However, in the short term, it appears to me that there is more volatility to come and in conjunction with other issues in the economy, the crypto exit is a contributor to an upcoming correction within the US economy.

Set up a FREE consultation with us if you are interested in figuring out YOUR plan for a downturn. Click here!